Flexible office space has been one of the hottest topics in the commercial

office market. The rise of Coworking has dominated headlines but activity and

supply of flexible office space includes much more than just Coworking.

Over 30% of the public listings on LiquidSpace come from private businesses,

who are sharing their extra space, while building owners have also jumped into

the mix. The amount of Direct Landlord space doubled in the last year and

now account for 7% of the publicly available supply, a number we expect to

continue to grow rapidly as more owners begin entering the LiquidSpace

network.

The flexible office market is clearly taking off. Read on to understand what,

and who, is driving the growth and where this category is headed over the

coming year and beyond.

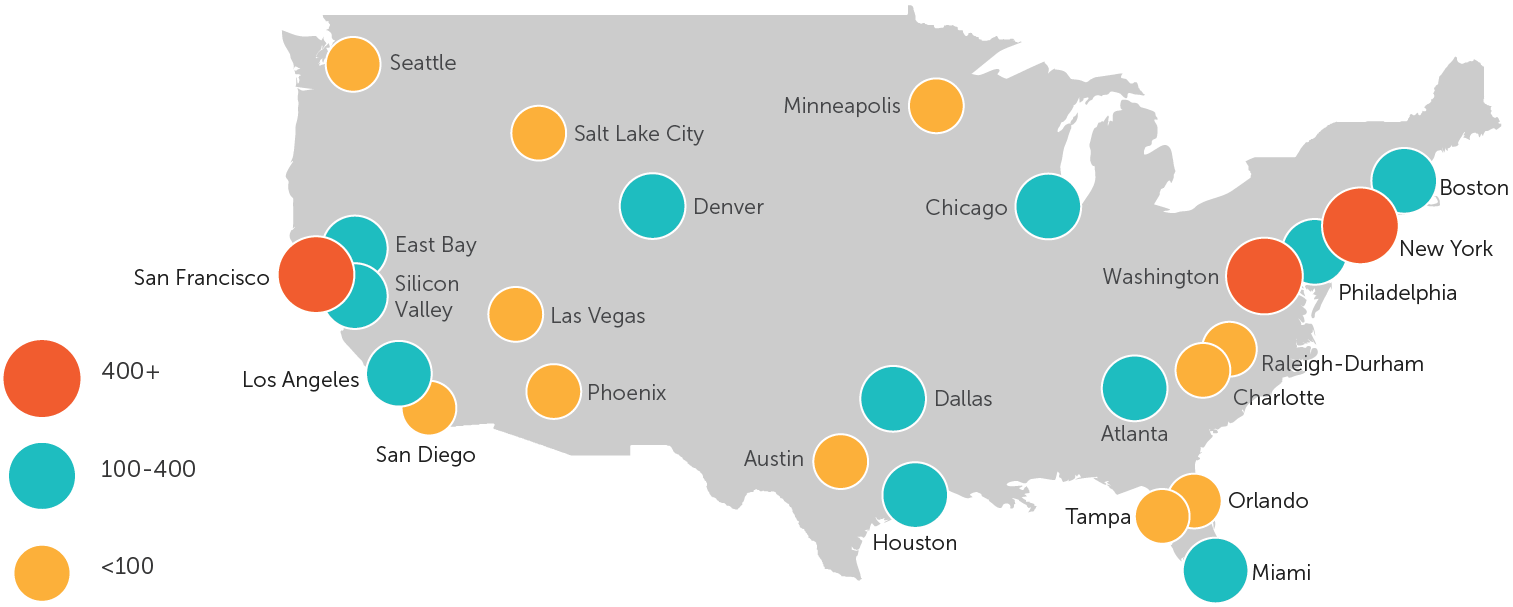

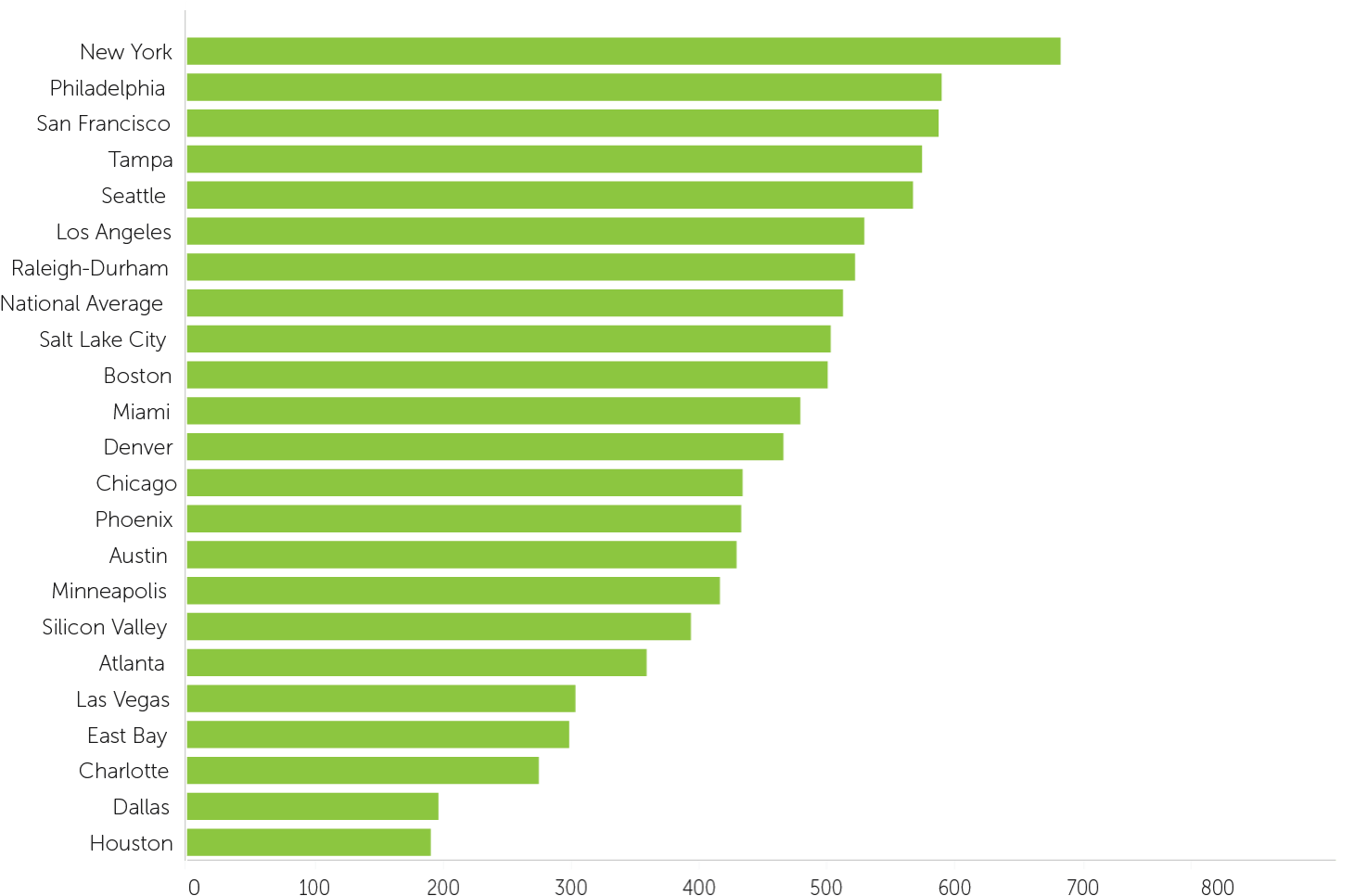

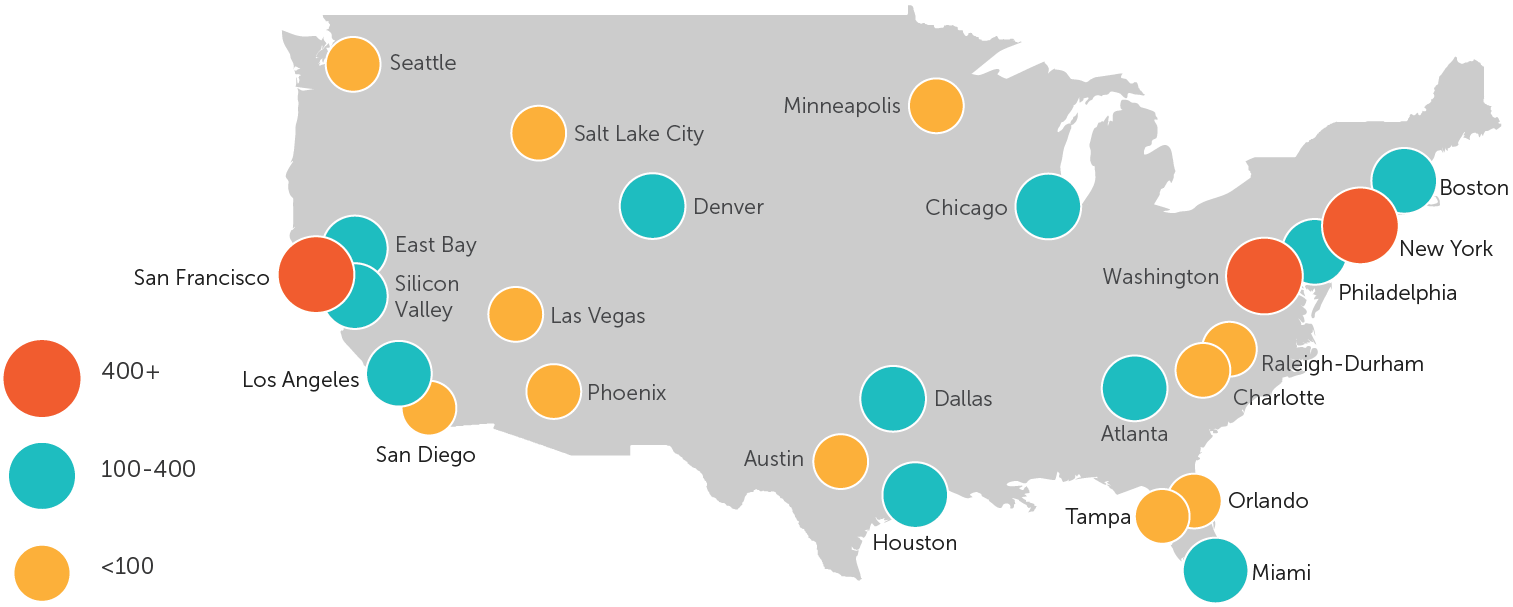

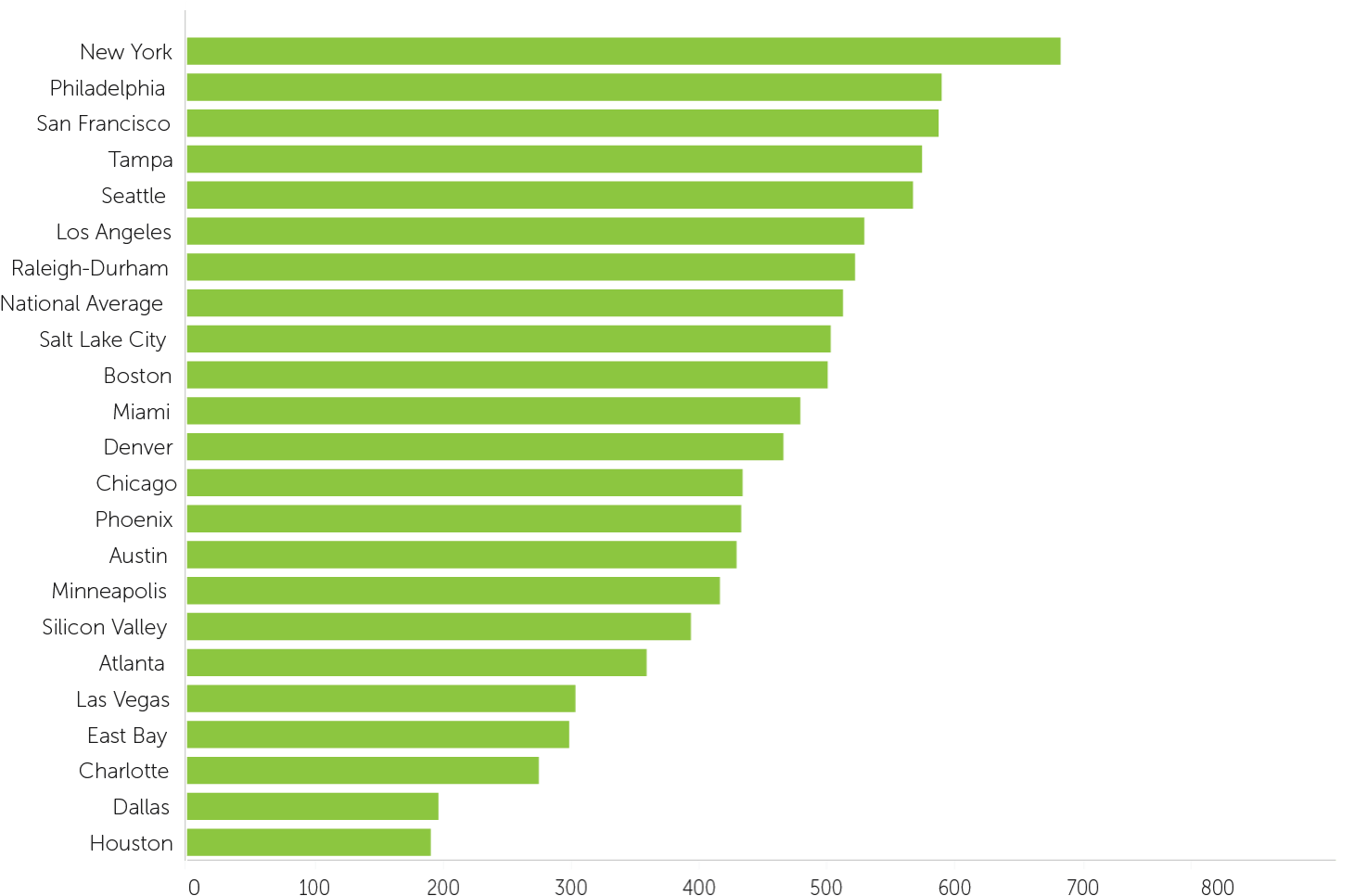

Current Available Workspaces in Top 25 US Markets

Companies Want Flexibility

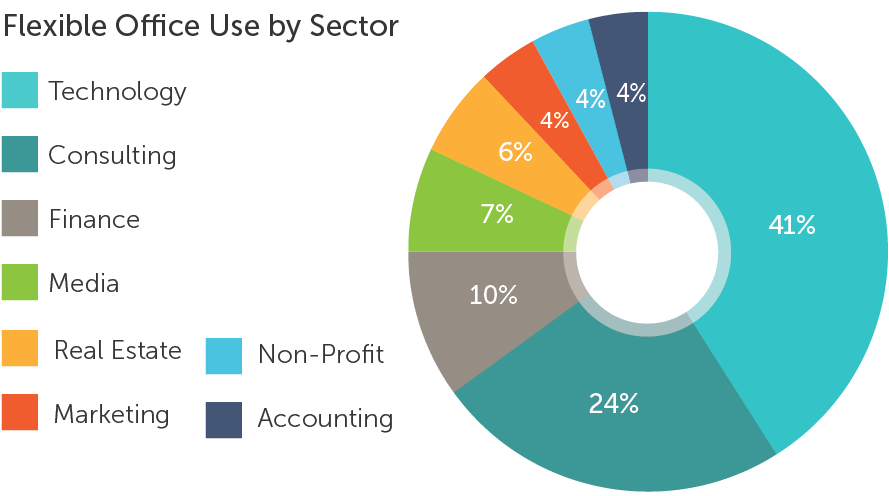

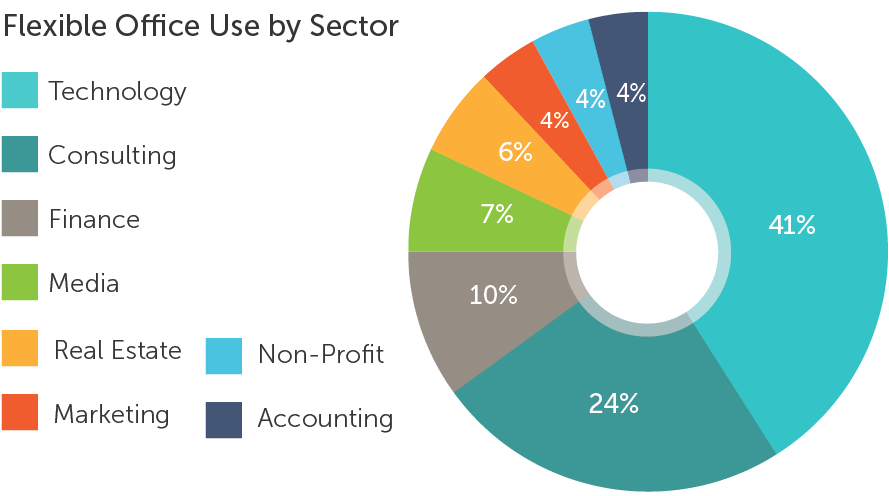

Nearly Every Type of Business Needs Flexibility

In this new era of shortened business

cycles, contract assignments, and

as-needed staffing, regional sales teams,

consultants, and distributed workforces

have begun to embrace flexible office

space. The need for flexibility, to position

teams close to customers or a key

partner, or to tap another market for

talented workers are just some of the

underlying factors motivating companies

to book flexible space. Not surprisingly,

technology companies lead the category

of companies currently demanding

flexible space, followed by consulting,

financial services, and a wide range of

other sectors.

Rising construction costs and a

challenging environment for new

development have also pushed tenant

improvement costs to record levels

making the cost for committing to

long-term space more burdensome.

As goods such as cars, food, hospitality

and even employment embrace the

flexibility afforded in an on-demand

marketplace, tenants are increasingly

demanding flexibility in their office space.

An Increasingly Mobile Workforce

The ubiquity of cellphones, laptops, fast

wifi, video conferencing, cloud

computing, and collaboration software

has freed many office workers from the

need to drive to a central office each

day. Many companies have realized that

in the competitive battle for skilled

workers, workplace flexibility is a potent

weapon to attract talent. Giving back

several hours of commuting time each

day is an attractive incentive.

Yet working from home or the proverbial

coffee shop are not ideal options for

many workers. Teams still need office

space to meet customers, to collaborate

with teammates, or to simply have a

place to focus without distractions.

These benefits, as well as many more,

are driving demand for flexible

alternatives.

A Variety of Suppliers are Providing Space

Traditional owners now see flexibility as

a tool to fill spaces where traditional

5-year deals don't fit. They also realize

that providing flexible alternatives attract

fast-growing companies that could be

the anchor tenants of the next cycle.

Private businesses are also getting in on

the action, recognizing the opportunity

to monetize their unused space they are

sharing everything from an extra desk to

an unused floor.

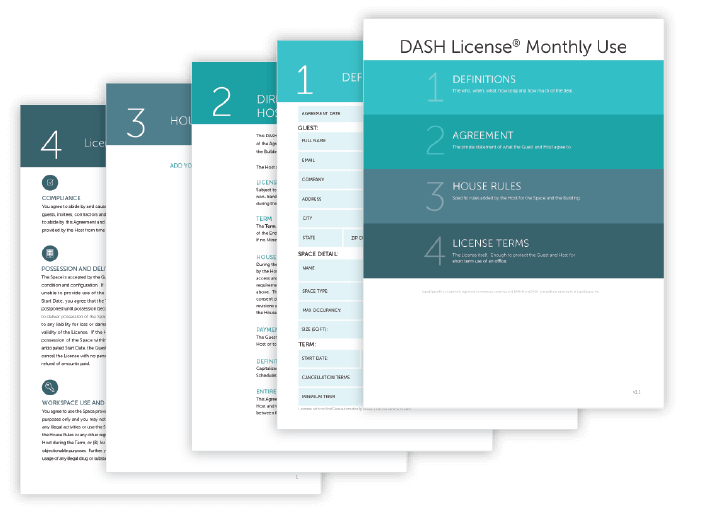

What Makes Flexibility Possible?

The emergence of digital networks that connect

and transact office space as well as legal

frameworks like LiquidSpace’s DASH License®

allow companies to book spaces on

flexible terms.

Learn more at liquidspace.com/dash

Defining “Flexible”

Office Space on a Variety of Terms

Flexible office space is defined to be any space that can be rented on a term that is

shorter than the standard 5 or 10 year deal. Within the LiquidSpace network, supply

providers can offer and transact spaces with a minimum term of an hour, a day, a

month or any term up to 3 years.

This report focuses on spaces available to rent by the month. That classification

includes spaces that have minimum terms ranging from one month up to three

years. Flexible office space includes space that is both furnished and unfurnished.

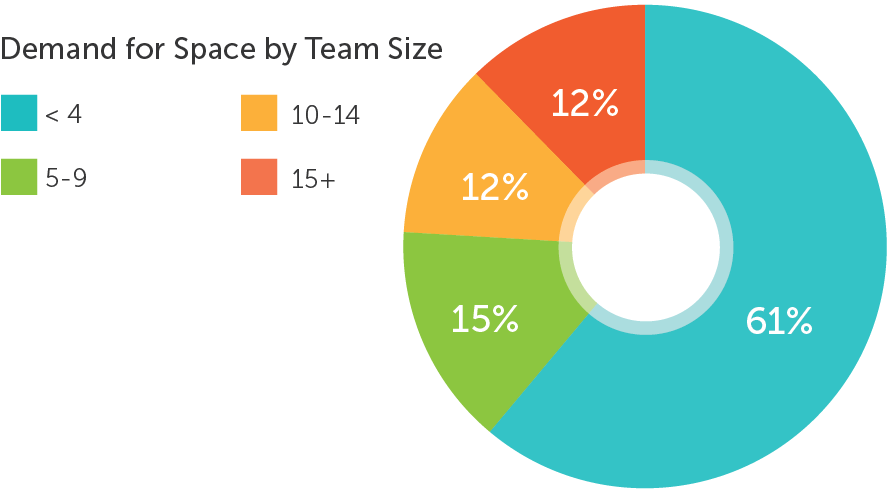

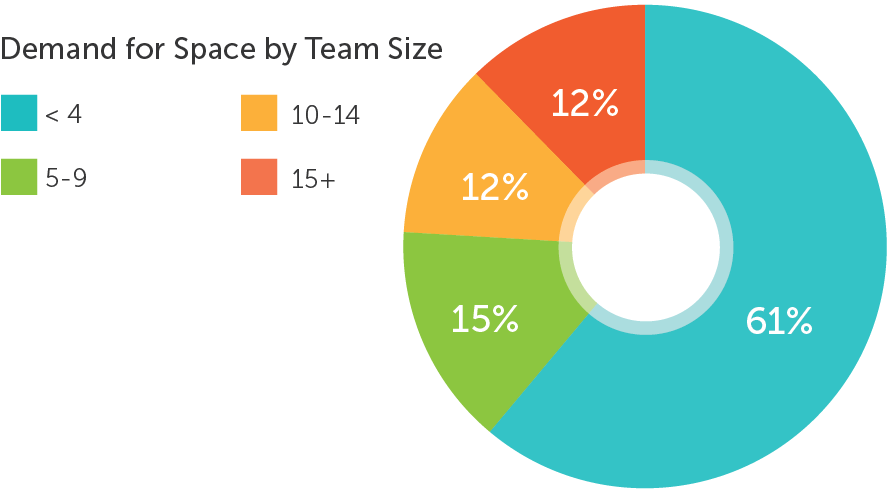

Demand for Flexible Office Options Spans Sizes

Rapid growth and changing business conditions are pushing businesses and teams

of all sizes to seek out flexibility in their office space. Nearly 40% of the demand we

see in our network is for spaces to accommodate teams of 5+. 12% of teams are

looking for space for 15+, and numerous companies are searching to accommodate

100+ employees.

Supply from Multiple Sources

Coworking is just the start...

Share of Supply by Source

WAAS - Serviced Offices and Coworking

Traditionally, the Workspace-as-a-Service

(WAAS) category was the dominant provider of

flexible options in the market. However, with

private business and traditional landlords

beginning to offer their spaces on flexible terms,

WAAS providers have started to see increased

competition. WAAS comes in two general

categories, Serviced Offices and Coworking

spaces.

Serviced Offices got their start in the 1970’s and

are typically professional, full-service spaces

that cater to those looking to do private work in

a shared environment with office amenities and

services. Coworking spaces began showing up

in the last decade and come in a range of flavors

but often have an entrepreneurial, creative,

“techy” vibe to their shared environments. They

tend to include a mix of open floor space and

some private offices and often emphasize

community and networking among their users.

Direct Landlord Space

Increasingly, traditional building owners are

listing their spaces on flexible terms. Within the

LiquidSpace network, direct landlord space has

doubled in just the past year.

Direct Landlord space on our network includes

private furnished and unfurnished spaces

available on flexible terms, direct from building

owners. For unfurnished spaces in particular,

LiquidSpace offers fitout-as-a-service to furnish

spaces, available on flexible terms to tenants and

no cost to landlords.

Private Businesses

Private Businesses are providing spaces in a

range of space types including extra desks,

offices, suites and full floors.

Historically, Private Businesses who had extra

office space were limited in the ways they could

monetize that space, primarily through

subleases. The emergence of the flexible office

space category has greatly increased private

businesses’ ability and willingness to share their

space. The flexible structure of these deals is

particularly appealing because it gives these

companies freedom to monetize extra space

when empty and reclaim that space when they

need it for their own use. Additionally, marketing

the space is simple. Transactions, negotiations,

and contract negotiations are quick and easy,

when done on the LiquidSpace platform.

A Range of Options

A variety of flexible office space is typically offered. These include Open Desks,

Dedicated Desks, Offices, and Office Suites.

Desks

Desks are available in two main types open desk or a dedicated desk.

Open Desks allow access to communal desks in a shared

environment, which desk an individual uses can change day to day,

and some agreements may limit the total number of days per month

that can be use.

Dedicated Desks are a specific reserved desk that is part of a shared

environment.

Private Office

Private office for an individual with the option to set up equipment.

A private office is accessed and part of a shared environment.

Team Office

A larger private office but to accommodate a group.

Office Suite

An office suite is a private multi-use space for a team. Often a

combination of private office(s), meeting room space and open

seating team areas.

Average Monthly Rent per Person

Average Rental Rates are calculated by dividing the asking rental rate by the maximum capacity

of each space. When no spaces are available, prices are based on historical averages.

-

For more info contact Andrew Liverman

andrew@liquidspace.com | Director of Product Marketing | San Francisco, CA